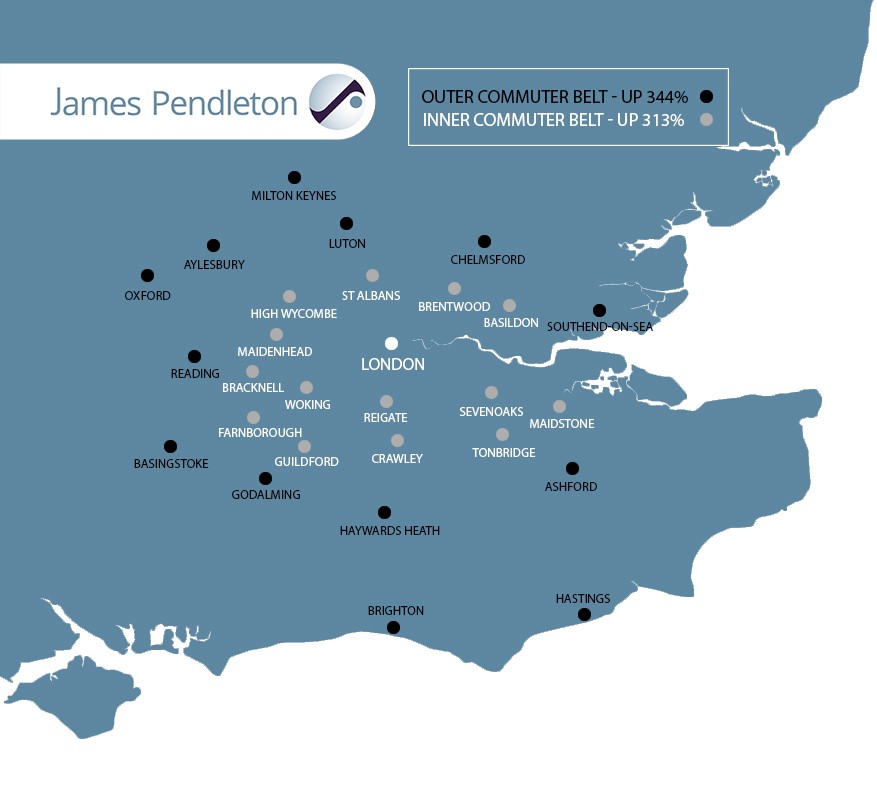

Research by independent estate agent James Pendleton has revealed that house prices within London’s second commuter belt are catching up with those closer to London.

Where is the 'second commuter belt'?

The research found that the average cost of a property has risen by 313% over the past 20 years in the capital’s ‘heritage belt’ – which comprises towns such as Woking, Sevenoaks and St Albans – to trade at discount to average outer London prices of 9.7%.

However, the South East’s second commuter belt – which comprises locations further from London, such as Brighton, Oxford and Milton Keynes – has seen the average house price rise 344% over the past two decades to trade at an average discount of 26.2% to outer London.

In comparison, house prices in England have risen 293% from £61,902 to £243,582 in the same period, while houses in outer London have risen by 367% from £92,660 to £432,497.

- 585 one-bed flats priced at over £1m

- RICS reports fall in new homebuyer enquiries

- Annual house price growth slows

The average price of a house in the traditional commuter belt is £390,362, an increase from just £95,331 in 1998.

Houses within the outer belt are selling for an average of £319,147, a rise from £73,735 two decades ago.

“It’s hugely counterintuitive to see house prices rising faster, the further from London you go as it runs contrary to the received wisdom illustrated by steep rises in the capital,” said Lucy Pendleton, co-founder and director at James Pendleton (pictured above).

“What that tells us is that there has been a generational shift in thinking.

“Workers in the capital wouldn’t have dreamt of commuting from some of these outliers 20 years ago, but financial realities have forced people to swallow ever bigger journeys.

“The fact that hundreds of thousands of people came to the same conclusion when faced by the same economic challenges is hardly surprising and that’s what shapes these long-term trends.

“The most worrying diagnosis, however, is that there is a growing disparity between the haves and the have-nots, who use their respective wealth to either stay put in London or jump the traditional commuter belt in search of homes they can actually afford.”

Leave a comment