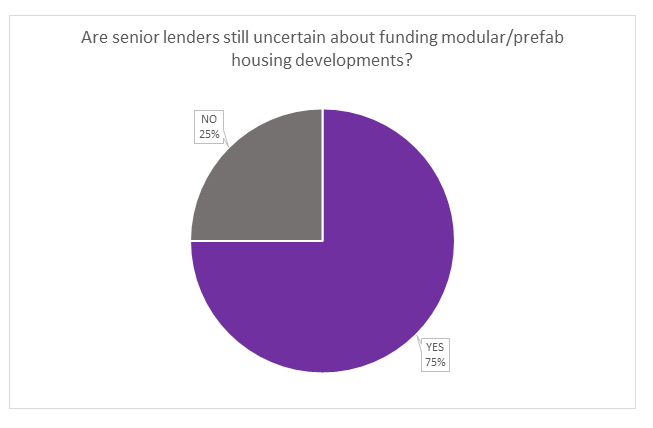

A recent survey conducted by Development Finance Today found that 75% of respondents felt senior lenders were still uncertain, with the remaining 25% disagreeing.

Why might lenders be uncertain?

Brian Maunder of Totally Modular felt the risk-averse nature of the UK banking system meant they needed to feel assured in the security they held against the loan.

“The UK off-site modular home industry is still in its embryonic phase, traction is gathering with many more local authorities and housing associations undertaking pilot projects.

“It will take time for this to become the norm, but it is happening and the big housebuilders are all now taking notice.

“Those who are already in the sector are seeing the change, but some lenders are lazy or complacent, but time will sort this.”

Rico Wojtulewicz, policy adviser for the House Builders Association, added: “Many lenders lack the expertise to lend on modular or prefab developments and, therefore, it may be pertinent for industry to establish a design code to ensure quality and encourage lender confidence.”

Steve Cook of Investec Structured Property Finance said there were challenges with modular and prefab development lending which led to natural caution from lenders.

- Do development lenders understand construction?

- Offsite construction not silver bullet to solving housing crisis, says FMB

- Is modular housing really cheaper?

“While the land purchase funding structure is no different to a traditional development, when it comes to funding construction stage payments for a modular scheme the challenge for a lender is around willingness to advance loan monies to pay for works that are taking place off-site and, therefore, not adding value to the site over which the lender has a mortgage.

“Lenders have always been reluctant to fund deposits and materials held off-site, so in a default situation on a modular scheme the complications of a lender trying to secure a deposit refund or get units delivered to a site would mean the amount of money involved as ‘off-site risk’ could be considerable.”

Michael Dean, principal at Avamore Capital, added: “I think many senior lenders are approaching modular with trepidation.

“I think a lot of this is driven by a lack of experience and knowledge.

“Additionally, it is not clear whether all mortgage lenders will finance homebuyers purchasing a new-build property which has been constructed through a modular construction method.

“As a development lender, you want to know that the property you are funding the build for will be eligible for a mortgage and any uncertainty surrounding this will make a development lender less willing to fund that development, which is our main reluctance to fund modular builds rather than a lack of understanding around the construction method.”

Emma Burke, head of development origination at Octopus Property, felt there wasn’t a proven demand for modular build outside of student accommodation and healthcare.

“The business model requires costly forward payment bonds between the developer and modular construction company.

“Modular build cost efficiencies are largely dependent on scale and lenders would have concerns surrounding legal ownership of the goods, i.e. when title passes to the developer, with legal due diligence resulting in substantial advisory fees.”

Are there lenders willing to fund modular/prefab developments?

Modular housing is becoming more common in the UK

Brian said that there were a number of lenders keen to be the forerunners in the sector.

“I have had meetings with a number of them, showing [them] the factory and what we do.

“All who came said they were comfortable.

“One insurer said he was more comfortable about the factory home than the site built.”

Ashley Ilsen, head of lending at Regentsmead, said he was a big fan of modular housing.

“If you look at construction in other major economies – such as USA and Germany – a lot of construction is based on a pre-fabricated system.

“They invariably allow for quicker construction times which offers great financial benefits to the developer.

“Often a superstructure can be erected within days.”

David Penston, head of property at Assetz Capital, added: “Modular housing has the potential to become the next big thing to help address the current housing crisis.

“This is due to construction that uses modular and off-site manufacturing techniques helping to deliver housing more quickly and it is for this reason in particular that it has received strong backing from the government.”

Meanwhile, Steve explained: “We have experienced modular schemes in the past with student accommodation and budget hotel developments, but we are now seeing more and more sizeable residential schemes, including build-to-let, being assessed using the modular method.”

How can more lending be encouraged?

There are concerns over quality control

“Housing associations have already embraced this new type of construction as part of their development programmes – the more common this type of construction becomes, the more comfortable lenders will feel about funding it,” said James Prestwich, head of policy at the National Housing Federation.

However, David said there was still work to be done to address potential issues with modular housing.

“Some of the main challenges include quality control, as well as the difficulty of lending against the elements of the construction that are being built off-site and away from the property over which the lender has their security.

“Building warranties for these new off-site manufacturers is also an emerging area that needs closure in order to widen the marketplace for homebuyer mortgages from high street lenders as the exit for the developer.”

Ashley concluded: “There needs to be a better standard across the industry of how various building methods work and I think there is plenty of room for improvement here.”

Leave a comment